What Is Bull Trap And How It Works 2023

A "bull trap" is a circumstance that occurs in trading when a trader purchases an asset with the expectation that its price will continue to grow, only to find that the asset's price drops significantly after it reaches a new high.

Author:Scarlet SunsetReviewer:Maxwell CanvasMar 21, 202334 Shares1.1K Views

A "bull trap" is a circumstance that occurs in trading when a trader purchases an asset with the expectation that its price will continue to grow, only to find that the asset's price drops significantly after it reaches a new high.

When there is ambiguity in the market or when there is widespread dissemination of incorrect information regarding a specific asset, bull traps are likely to emerge.

It is called a "bull trap" because unsuspecting traders are tricked into thinking that an asset whose value is going down is actually going up.

This illusory sense of safety can result in significant financial losses.

When it is thought that a bull trap is being set, traders should get out of the trade as soon as possible or initiate a short position.

In these kinds of circumstances, stop-loss orders can be really helpful, particularly when the market is moving quickly and you want to avoid being carried away by your emotions.

Finding a bull trap can be challenging, as is the case with a number of other aspects of trading.

But the best way to avoid bull traps is to be aware and keep an eye out for early warning signs, such as breakouts with low volume.

Below, you'll find further discussion about this topic.

How Does A Bull Trap Work?

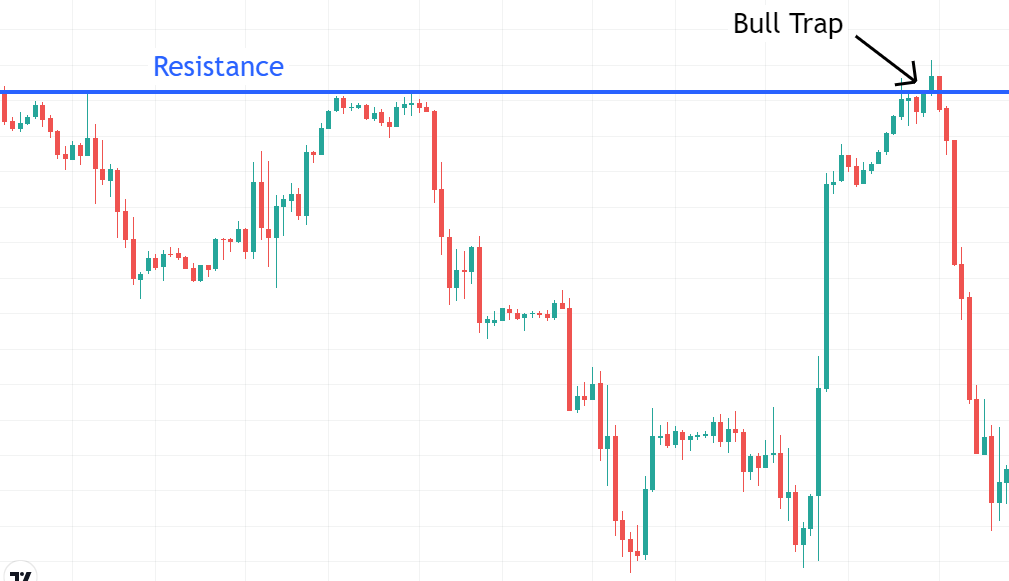

When a trader or investor purchases a security that has broken out above a resistance level, which is a frequent technique based on technical analysis, they have fallen victim to a bull trap.

Even though most breakouts are followed by significant moves upward, the value of the investment could suddenly change direction.

Because traders and investors who bought the breakout find themselves "stuck" in the trade, these situations are referred to as "bull traps."

Bull traps can be avoided by traders and investors if they look for confirmations right after a breakthrough.

A trader might, for example, look for higher-than-average volume and bullish candlesticks after a breakout to confirm that the price is likely to rise further in the near future.

A breakout that results in low volume and indecisive candlesticks—like a Doji star, for example—could be an indication that a bull trap is about to be set.

Bull traps are psychological situations that happen when bulls don't back a rally that is above a breakout level.

This could be due to a lack of momentum or profit-taking on the part of the bulls. If bears observe divergences, they might quickly seize the opportunity to sell the security.

This would result in prices falling below resistance levels, which would then set off stop-loss orders.

If a bull trap is anticipated, it is best to get out of the trade as soon as possible and cut losses as soon as possible.

If a bull trap is found, it's best to know about warning signs like low volume breakouts ahead of time.

Stop-loss orders can be very helpful in these kinds of situations, especially when the market is moving quickly and you don't want your emotions to control your decisions.

A Bull Trap Example

In this example, the security's price is going down and it hits a new 52-week low before jumping back up quickly on high volume and hitting trendline resistance.

Many traders and investors are paying attention to the move because they expect it to break out over the trendline resistance.

However, security makes a U-turn at the resistance level and then turns dramatically lower from these levels.

Unless they employ aggressive risk management strategies, new bulls often end up being cornered in losing long trades and suffering significant financial losses.

The trader or investor could have avoided the bull trap by waiting to buy the securities until a breakout happened first, or at the very least, by placing a stop-loss order right below the level where the breakout happened to limit their losses.

What Is The Meaning Of The Bull Trap In Crypto Market?

Due to the lightning-fast recoveries, bull traps are frequently witnessed in the cryptocurrency market. They are also known by the term "dead cat bounce."

The same logic applies to the cryptocurrency market as it does to any other market: bull traps.

For example, if the price of an alternative cryptocurrency has been going up steadily over the past few days, you might think that this trend will continue.

You make your purchase now, then sit on it while you wait for the price to rise, so you may make a profit when you sell it later.

On the other hand, the opposite may occur, and you find yourself caught in a position where you cannot win.

You watch for a downward trend and then wait for a bullish reversal so you can buy the dip.

You do this because you believe you are getting a good deal when you buy the asset.

When the price starts to go backward and start going down again, the trap shows itself for what it is.

How Does Bull Trap Trading Work?

The takeaway from the bull trap is that buying at the very first sign of a probable fresh upsurge might be risky. This is the lesson that can be learned from the bull trap.

Because there is relatively little general buying pressure to begin with, many of these attempts to force prices higher may be unsuccessful.

When a deal turns out to be a losing position, some traders may make emotional trading moves, which can significantly affect prices.

This situation, which is called "stuck traders," could be used to make money under certain circumstances.

So, if you are trading in a downtrend, you should keep an eye out for bull traps whenever the price moves above a resistance level or an earlier swing high.

You should also think about entering a short position whenever the price starts to drop below the resistance level or an earlier swing high.

Here are some potential next steps for you to take into consideration.

- By opening a demo account, you can make a practice trading account or try your hand at bull traps on the financial markets.

- Spread bettingand contracts for difference are two methods that make this possible (CFD).

- Utilize the product library to look for charts of assets, and after you've found one that's in a downward trend, you can proceed.

- Pull up some charts of assets using the product catalog, and look for one that is currently experiencing a downward trend.

- Marking the top of a price range or the highest point of a recent swing can help you find a possible resistance line on the chart.

- This can be accomplished with the help of a comprehensive selection of drawing tools.

- Watch for the price to break above the level of resistance or swing high before acting.

- If the price drops back down below the level that represented resistance, you should think about placing a short trade because the rise higher was a false signal.

- Technical indicators and candlestick patterns are both examples of other tools that can be used to confirm.

- If you want to keep your exposure to risk under control in the event that the price keeps climbing higher, it would be a smart idea to put a stop-loss order above the most recent high.

- If the transaction is turning a profit, you should think about an exit strategy.

- Setting a profit goal or using a stop-loss order that moves with the market are two ways to get out of a trade.

What is a Bull Trap in Trading? Learn How To Identify It

People Also Ask

Is A Bull Trap Bullish Or Bearish?

A "bull trap" is a situation that is bullish in the short term but bearish in the long run. The bull trap is designed to attract buyers, which results in a temporary increase in price. This, in the end, gives way to selling pressure, which in turn causes the price to collapse.

How Can You Tell A Bull Trap?

A variety of technical indicators, including breakout points, resistance levels, and more. Investors can avoid getting caught in bull traps by always keeping an eye on longer-term price charts, keeping an eye on simple moving averages and other technical indicators, and knowing where important support and resistance levels are.

What Causes A Bull Trap?

When a market or asset that is currently experiencing a downward trend experiences a momentary spike in value, this is known as a "bull trap." When investors see that prices are at a historical low, they start buying shares, which temporarily drives up the price. During downturns, bull traps are a typical occurrence.

Conclusion

Some investors can be led astray by a bull trap into believing that a market or an individual stock price has reached its bottom and that it is now a good time to buy.

However, it turns out that this is not a good time since the price quickly begins its decline, luring purchasers into an investment that would result in a loss of money.

In many respects, it is the polar opposite of a "bear trap," which is a strategy used to trick traders into liquidating their positions too early during a bull market.

Scarlet Sunset

Author

Scarlet Sunset is a captivating and confident transgender individual who radiates sensuality and embraces her unique beauty. With a radiant smile and a touch of red lipstick, she captivates hearts by the poolside as the sun dips below the horizon, casting a warm glow on her unforgettable presence.

Despite societal norms and expectations, Scarlet celebrates her body, proudly defying conventional standards of beauty. Her curves tell a story of self-acceptance and empowerment, challenging stereotypes and inspiring others to embrace their own bodies without reservation.

Maxwell Canvas

Reviewer

Maxwell Canvas, a charismatic and fearless crypto evangelist, defies conventions and blazes a trail in the realm of digital currencies. With his unique physique serving as a symbol of resilience, he challenges societal norms and proves that true expertise transcends appearances. Against a backdrop of a blurred and ever-shifting market, Maxwell's work becomes a masterpiece, painting a vivid picture of knowledge and inspiration.

With unwavering passion, Maxwell empowers others to embrace the transformative potential of blockchain technology. His captivating presence and unyielding dedication captivate audiences, turning skepticism into curiosity and igniting a spark of interest in the world of cryptocurrencies. Maxwell Canvas stands as a visionary force, leaving an indelible mark on the crypto landscape, inspiring others to explore decentralized possibilities and embrace a future of innovation and financial empowerment.

Latest Articles

Popular Articles