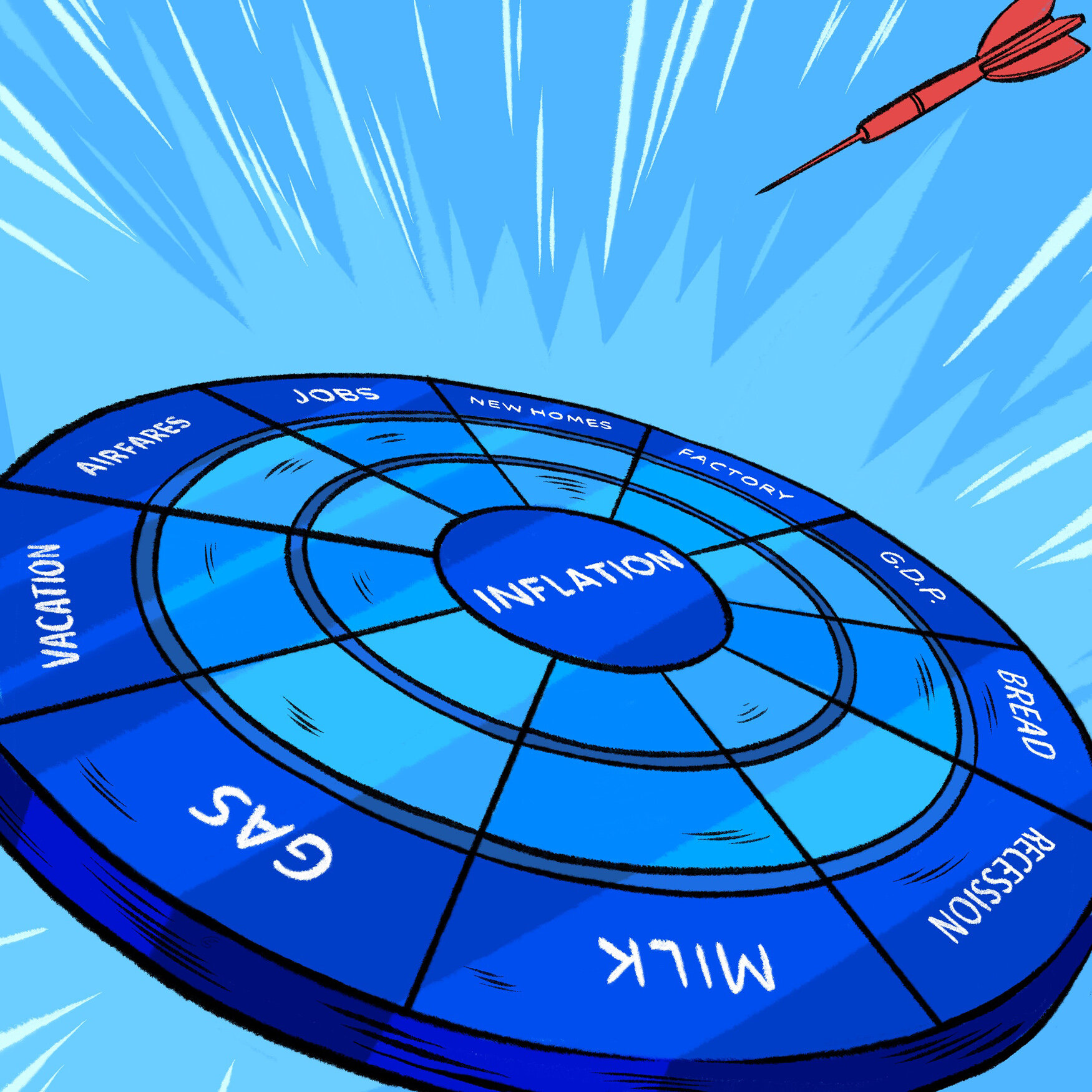

How To Survive This Economic And Inflationary Climate?

How to survive this economic and inflationary climate? Along with death and taxes, inflation is almost certainly something that will happen over time. Although there have been numerous brief deflationary spells in the world, in general, economic growth is accompanied by inflationary forces.

Author:Xander OddityReviewer:Dr. Felix ChaosphereOct 21, 2022225 Shares2.9K Views

How to survive this economic and inflationary climate? Along with death and taxes, inflation is almost certainly something that will happen over time.

Although there have been numerous brief deflationary spells in the world, in general, economic growth is accompanied by inflationary forces. When there is an excess of money in the economy, the cost of commodities might rise, which is known as inflation.

How To Deal With Inflation As An Individual?

How to survive this economic and inflationary climate? You can deal with inflation with these tips.

Bargain For Lower Costs For Regular Expenses

Andres Lares, the managing partner at Baltimore's Shapiro Negotiations Institute, asserts that you can bargain for a better price on nearly anything to offset increased pricing.

Lares suggested starting by establishing a rapport before inquiring about any discounts or programs you might be eligible for. "Asking is not harmful."

The annual percentage rate (APR) on your credit card, streaming services, insurance premiums, cable bills, cell phone plans, and gym memberships are all good examples of recurring costs that are often subject to change.

According to surveys, customers who contact and request a reduced rate nearly always succeed, which can be a terrific tool for cutting monthly spending.

Purchase Stocks

Despite the general lack of faith in stocks that most people express, holding some stocks can be a very effective method to fightinflation. Consider your home as a business.

A business will also be affected by inflation if it cannot appropriately invest its funds in endeavors that will provide returns greater than its costs.

How To Survive An Economic Recession (And Make Huge Profits)

Purchase A Home

Real estate is always a wise investment if it is done for the correct reasons, such as purchasing a home to live in. When a buyer intends to sell the home they have purchased for a profit, problems arise.

The normal individual should concentrate on buying a home with the intention of owning it, even if just for a few years, even though seasoned real estate investors are able to uncover hidden values in properties.

Real estate investments normally take a long time to pay off; value increases usually take place over a number of months or weeks.

Spend Money On Yourself

Investing in yourself is by far the best investment you can make to be ready for an unpredictable financial future. one that will boost your potential income in the future.

This investment starts with high-quality education and continues with maintaining current skills and picking up new ones that will correspond to the ones that will be most in demand in the not-too-distant future.

Being able to adapt to a company's shifting needs could help you protect not only your career but also your compensation against inflation and economic downturns.

Rhex1 from Redditshared some tips to deal with inflation, "Start connecting with others in the same situation and network. Trade for skills or items. Develop a second economy within the group. This is how people have survived such times throughout history."

People Also Ask

How Can We Survive The Effects Of Inflation?

- Review your spending patterns.

- Sparingly take on new debt (and stay away from variable rates).

- Turn into a sale shopper.

- To maximize reward and loyalty programs.

- Be wise with your money.

What Assets Are Best During Inflation?

- Cash.

- Stocks.

- Real Estate.

- Gold.

- Commodities.

- Short-Term Bonds.

- Cryptocurrency.

How To Survive Inflation 2022?

- Cut out unneeded spending.

- Shop differently for groceries.

- Reduce energy usage in your home.

- Avoid wasting gas.

- Clear up your debt.

- You should up your revenue.

- Keep your future savings.

Conclusion

How to survive this economic and inflationary climate? The bad effects of inflation are, of course, canceled out if a household's main sources of wealth growth, asset appreciation, and income growth, rise at the same rate or faster than inflation.

But as it has been often observed, it is not always the case. Even though the minimum wage has gone up, recent average wage increases haven't kept up with the general rise in the prices of goods.

Xander Oddity

Author

Xander Oddity, an eccentric and intrepid news reporter, is a master of unearthing the strange and bizarre. With an insatiable curiosity for the unconventional, Xander ventures into the depths of the unknown, fearlessly pursuing stories that defy conventional explanation. Armed with a vast reservoir of knowledge and experience in the realm of conspiracies, Xander is a seasoned investigator of the extraordinary.

Throughout his illustrious career, Xander has built a reputation for delving into the shadows of secrecy and unraveling the enigmatic. With an unyielding determination and an unwavering belief in the power of the bizarre, Xander strives to shed light on the unexplained and challenge the boundaries of conventional wisdom. In his pursuit of the truth, Xander continues to inspire others to question the world around them and embrace the unexpected.

Dr. Felix Chaosphere

Reviewer

Dr. Felix Chaosphere, a renowned and eccentric psychiatrist, is a master of unraveling the complexities of the human mind. With his wild and untamed hair, he embodies the essence of a brilliant but unconventional thinker. As a sexologist, he fearlessly delves into the depths of human desire and intimacy, unearthing hidden truths and challenging societal norms.

Beyond his professional expertise, Dr. Chaosphere is also a celebrated author, renowned for his provocative and thought-provoking literary works. His written words mirror the enigmatic nature of his persona, inviting readers to explore the labyrinthine corridors of the human psyche.

With his indomitable spirit and insatiable curiosity, Dr. Chaosphere continues to push boundaries, challenging society's preconceived notions and inspiring others to embrace their own inner tumult.

Latest Articles

Popular Articles