Myindigocard - A Special Type Of Official Indigo Platinum Card

A form of official Indigo Platinum card called Myindigocard was created for cardholders. It is one of the best solutions for cardholders who struggle to keep their credit score. Top businesses frequently deny credit cards because of their poor financial standing or rating.

Author:Xander OddityReviewer:Dr. Felix ChaosphereDec 19, 202222 Shares415 Views

A form of official Indigo Platinum card called Myindigocardwas created for cardholders. It is one of the best solutions for cardholders who struggle to keep their credit score. Top businesses frequently deny credit cards because of their poor financial standing or rating.

Myindigocard is an excellent choice for those with poor credit or no credit history; it does not require a credit check for prequalification, which may be very helpful for students and those who need a credit card after bankruptcy.

Since it has a low international transaction fee of 1% and reports to all three major credit bureaus (Equifax, TransUnion, and Experian), it is one of the best credit cards for helping you build or fix bad credit.

Following are some fundamental facts about this:

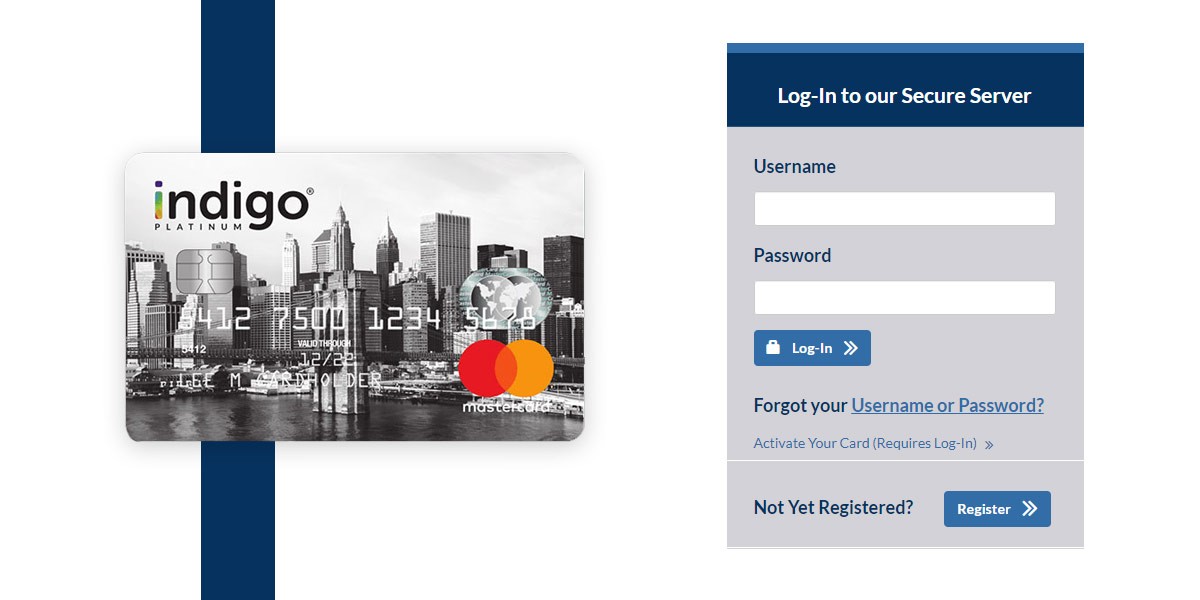

Registration Process

You can easily register in your myindigocard by following a few simple steps. Due to how easy and straightforward the registration process is, cardholders shouldn't worry about it. Follow the straightforward instructions listed here:

- To continue, access the official website. Click the register button after selecting the login option.

- You must now enter accurate information, such as your account number, social security number, and birthdate. Continue by clicking the Next button.

- You must also submit your contact information, email address, and personal information. Likewise, provide financial data.

- Setting a new username and password is now necessary. Select "Register" from the menu. A confirmation email will be sent to you once you select the registration option.

- Once you click the link to verify your account, you can log in to your myindigocard account.

- You may quickly sign in to your account using a username and password.

Logging into Myindigocard is straightforward and easy. Simply follow the instructions, and your fun is over.

Benefits Of Myindigocard

Before deciding to employ this alternative, you should be informed of its benefits. Below, we go into greater detail about a few of the benefits.

Credit Score

One variety of platinum is blue platinum. TransUnion, Experian, and Equifax are three credit reporting companies with whom MasterCard works. One of the three credit reporting bureaus normally determines an individual's credit score.

Therefore, those with a history of bad credit will be qualified for the myindigocard program. They will use their credit card to help you get loans from several other lenders.

Cost Is High

Prices will always increase significantly when a novel and distinctive feature is created. The yearly costs vary depending on the package, from $59 to $99. They offer new card members a variety of discounts.

You are given the choice of making a one-time payment. You can have faith in this card, even if it is a secured credit card deposit. The payment method is not only advantageous but also secure.

No Intervention Of Score

To apply for this indigo Platinum MasterCard, you do not need to meet the prerequisites for your past credit score.

Therefore, the past credit score of those who have recently gained voting rights is not a cause for concern. In summary, we can say that applying for a new credit card does not require you to use your current credit score.

Charges Are Applicable

One variety of platinum is blue platinum. The use of MasterCard is one of the extra benefits. It also provides extended warranty coverage. It only levies a 1% foreign transaction fee on all overseas transactions because of how traveler-friendly it is.

On the other hand, a small number of credit cards don't charge fees for cross-border purchases. You must first let go of something else in order to gain something bigger.

How To Use An Indigo Card?

The people who have bad debts and wish to rectify them honestly are typically the ones for whom the indigo MasterCard was designed. It is a straightforward unsecured credit card designed to raise credit scores.

It could be considered a different solution for bad credit scores. The MasterCard from Indigo can be purchased to make up for a low credit score. You can use the annual selection option, which will result in better outcomes.

Most of the time, people desire to raise their credit score either for free or for a small fee. Always choose the myindigocard option for a quicker outcome. One of the most excellent concepts now being produced is genuine. Choose it and embrace the idea behind it.

Let's Talk About The Indigo Credit Card: Keeper or Not? - Dave Ramsey,Budget,MyFICO,CreditKarma

People Also Ask

Is Indigo Credit Card Legit?

The safety of the Indigo Credit Card is no different from that of any other credit card issued on one of the four main credit card networks. It charges a $0-$99 yearly fee and offers credit limits of $300 or more. Despite being referred to as "unsecured," the Indigo Credit Card just lacks a security deposit requirement.

What Is The Highest Credit Limit On An Indigo Mastercard?

The $300 credit limit on the Indigo Mastercard is the upper limit. Unlike some other credit cards for those with bad or restricted credit, this credit limit is not the most competitive and is not subject to an increase.

How To Pay Indigo Card Online?

Access your Indigo online account after signing in, then select the "Bill Pay" tab. The routing and account information for your bank account should be entered together with the payment amount and due date. By 5 p.m. Pacific Time, you can submit your payment to get credit the same day.

How Do I Activate My Indigo Card?

You can activate your Indigo Credit Card online or over the phone by dialing their official number for customer care.

Is There Indigo Credit Card App?

No, there is no Indigo credit card app. Users using iOS and Android devices can currently access these features solely through the website's mobile-friendly version. Although the absence of an Indigo Mastercard app might be thought of as a disadvantage, the feature-rich online account more than makes up for it.

Conclusion

The above list contains the features of myindigocard. The best feature of your myindigocard will help you raise your credit score. It is a one-stop shop for improving your credit history and score. You are welcome to move forward, and doing so will improve your chances of getting a loan.

The greatest choice for cardholders in this situation is my myindigocard. People who are typically rejected by card companies will be given opportunities as a result of the indigo Platinum MasterCard.

Since the indigo MasterCard is safeguarded, the activity of the credit firms is preserved. It works positively, and you can effortlessly construct a credit history by using the myindigocard login portal.

The necessary selections can be obtained with the annual costs. The advantages of unsecured credit cards are available to cardholders, who can use them to their advantage to raise their credit rating. Despite being a traditional approach, it nevertheless required a credit rating limit.

Xander Oddity

Author

Xander Oddity, an eccentric and intrepid news reporter, is a master of unearthing the strange and bizarre. With an insatiable curiosity for the unconventional, Xander ventures into the depths of the unknown, fearlessly pursuing stories that defy conventional explanation. Armed with a vast reservoir of knowledge and experience in the realm of conspiracies, Xander is a seasoned investigator of the extraordinary.

Throughout his illustrious career, Xander has built a reputation for delving into the shadows of secrecy and unraveling the enigmatic. With an unyielding determination and an unwavering belief in the power of the bizarre, Xander strives to shed light on the unexplained and challenge the boundaries of conventional wisdom. In his pursuit of the truth, Xander continues to inspire others to question the world around them and embrace the unexpected.

Dr. Felix Chaosphere

Reviewer

Dr. Felix Chaosphere, a renowned and eccentric psychiatrist, is a master of unraveling the complexities of the human mind. With his wild and untamed hair, he embodies the essence of a brilliant but unconventional thinker. As a sexologist, he fearlessly delves into the depths of human desire and intimacy, unearthing hidden truths and challenging societal norms.

Beyond his professional expertise, Dr. Chaosphere is also a celebrated author, renowned for his provocative and thought-provoking literary works. His written words mirror the enigmatic nature of his persona, inviting readers to explore the labyrinthine corridors of the human psyche.

With his indomitable spirit and insatiable curiosity, Dr. Chaosphere continues to push boundaries, challenging society's preconceived notions and inspiring others to embrace their own inner tumult.

Latest Articles

Popular Articles