Taiwanese Billionaire Is Going To Sell 25,000 Rare Wine Bottles Worth $50M

Explore the lavish world of fine wine as a Taiwanese billionaire is going to sell 25,000 rare wine bottles worth $50m. Delve into the opulence, stories, and investment potential behind each bottle in this extraordinary cellar, promising a unique blend of connoisseurship and financial allure.

Author:Morgan MaverickReviewer:Professor JhizOct 05, 2023955 Shares106.1K Views

In the rarefied world of fine wines, where every bottle tells a story, a Taiwanese billionaire is going to sell 25,000 rare wine bottles worth $50M. Pierre Chen, the mastermind behind this opulent assortment, has declared his intent to part ways with a portion of his wine empire in what is poised to be one of the most significant wine auctions in history. Let's uncork the details of this lavish affair, exploring the origins, stories, and unparalleled value encapsulated in each bottle.

The Grandeur Of Chen's Wine Kingdom

Pierre Chen, a connoisseur with a passion for the finest wines, has meticulously curated a collection that surpasses the bounds of excess. Hailing from Taiwan, Chen's fortune, amassed through ventures in technology, has allowed him to assemble a cellar boasting 'more wine than could be drunk in a lifetime.' This accumulation is not merely an inventory of rare bottles but a testament to a life dedicated to the pursuit of oenophilic excellence.

What makes Chen's collection truly extraordinary is the narrative etched into each bottle. Every sip promises to transport the imbiber to the vineyards of Bordeaux, the hillsides of Tuscany, or the sun-kissed landscapes of Napa Valley. Chen's selection spans vintages that chronicle the evolution of winemaking, capturing the essence of different regions and the craftsmanship of revered winemakers.

Unveiling The Most Valuable Wine Collection Ever Sold

As the auction hammer prepares to fall, experts anticipate that Chen's collection could fetch a staggering $50 million, potentially setting a new benchmark for the most valuable wine collection ever sold. The sheer magnitude of the offering, combined with the rarity and prestige associated with the wines, places this auction in a league of its own.

Highlights Of The Auction

Taiwanese billionaire is going to sell 25,000 rare wine bottles worth $50M from his extensive collection, with some of the most valuable items estimated to cost up to $190,000 each at separate auctions that are going to held in Paris, London, New York, Hong Kong, and Beaune, the wine capital of the Burgundy area.

They are expected to fetch up to $50 million, making them the largest and most expensive wine collection ever offered at auction, according to Sotheby's, which is managing the five-part sale.

Chen's wine knowledge places him in a "league of his own," according to George Lacey, Head of Sotheby's Wine for Asia, who described the collection as "staggering in both volume and range." According to the auction house, the millionaire, who is the founder and chairman of electronics conglomerate Yageo Corporation, assembled the bottles over a four-decade period.

Lacey stated:

“„There is currently more wine in his cellars than any one individual could ever hope to drink in a lifetime, but wine is for drinking.- George Lacey

While the auction house would not confirm the exact quantity of Chen's collection, a spokesman for the auction business told CNNvia email that the number of bottles in his cellars goes "well into six figures", and those on sale represent only "a fraction" of his total holdings.

“„This is the ultimate wine collection, which comes to the market at a time when global interest in fine wine has arguably never been greater. This is a cellar in which every bottle has a story, and in which every wine is the best you could wish to own and enjoy.- Nick Pegna

With an estimated fortune of $5.5 billion, Chen is currently ranked 10th in Taiwan and 515th in the world by Forbes. Sotheby's stated in a press statement that he began collecting Bordeaux wines in the 1970s before expanding to "then much-less-fashionable wines" from the Burgundy producing region.

The most precious lots on offer are red burgundies, specifically rare vintages from the legendary La Tâche vineyard. Two "methuselahs" (six-liter bottles) from 1985 are worth at between $120,000 and $190,000 each. Another 1999 methuselah from the vineyard is likely to pay $100,000 to $130,000, while a 1971 three-liter "jeroboam" (or double magnum) is worth $110,000 to $140,000.

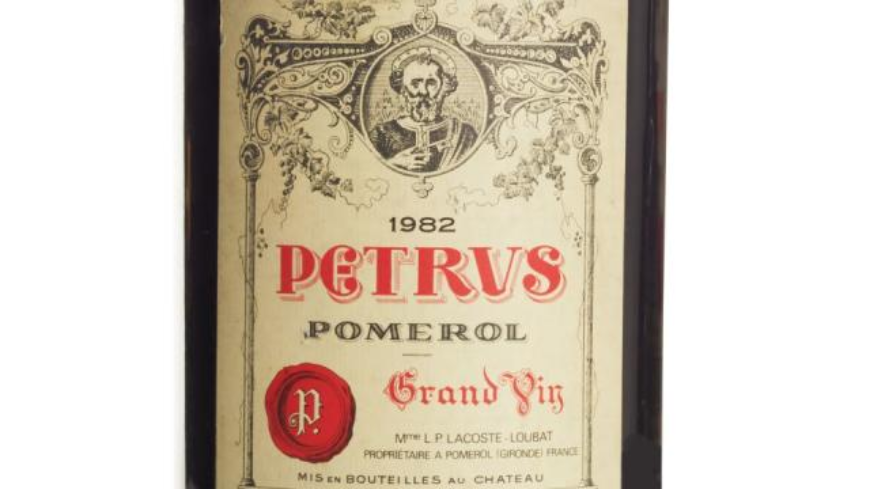

A rare six-liter bottle of 1982 Château Pétrus, a Bourdeaux red described by Sotheby's as having "legendary status amongst wine collectors," is likely to earn up to $65,000 in another auction. The sale also includes white burgundies and Dom Pérignon and Krug Champagnes.

The five sales, branded "The Epicurean's Atlas", will take place over the course of a year, with each focusing on a particular location or sort of wine. The first is scheduled for November in Hong Kong, with sales being planned for Paris, New York, and Beaune, Burgundy.

Chen will also open his own restaurant, Le Restaurant Blanc, in Paris, where he will serve as chief sommelier and offer wines from his collection. Meanwhile, the billionaire continues to make his own wine at the highly respected Grand Cru Musigny vineyard, where he purchased a block of property in 2015.

The sales come less than five years after Chen auctioned off $15 million of wine via Sotheby's. He is also an avid art collector, owning works by painters such as Pablo Picasso, Gerhard Richter, and Francis Bacon.

The Connoisseur's Dilemma

Chen's decision to part with a fraction of his collection raises an interesting question about the practicality of amassing such a vast array of wines. While every bottle represents a unique story and flavor profile, the sheer volume exceeds the bounds of personal consumption. This leads to the broader discussion within the world of wine aficionados about the balance between collecting for investment, appreciation, and the sheer love of the grape.

Auctioning In Style

Sotheby's, synonymous with high-profile art and luxury auctions, will play host to Chen's monumental wine sale. The renowned auction house is no stranger to orchestrating events of opulence, and the collaboration with Chen promises an evening that goes beyond the mere exchange of bottles for currency. It becomes a celebration of craftsmanship, culture, and the enduring allure of fine wine.

The Market Response

Chen's decision to divest a portion of his collection also prompts a reflection on broader trends in the fine wine market. As the global elite increasingly view fine wine as an alternative investment, these auctions become not just an exchange of bottles but a barometer for the health and vibrancy of the luxury wine market.

Culmination Of A Lifelong Passion

Beyond the financial implications and market dynamics, Chen's auction signifies the culmination of a lifelong passion. Each bottle reflects not just an investment but a journey, a memory, and a piece of the collector's soul. The legacy Chen leaves behind is not solely monetary; it is a narrative etched in the tannins and aromas of the wines he so ardently amassed.

Significance Of Fine Wine As An Investment

In the realm where grapes meet finance, fine wine has transcended its traditional role as a libation of pleasure to emerge as a sought-after alternative investment. The allure of investing in fine wine goes beyond the uncorking of bottles; it lies in the potential for both connoisseurship and financial gain. This exploration delves into the significance of fine wine as an investment, examining its historical roots, the mechanics of the market, and the factors that make it an intriguing asset class for investors.

A Vintage Investment

The notion of investing in wine is not a recent phenomenon but rather rooted in centuries of tradition. Historically, aristocrats and wealthy individuals have collected and cellared wines, recognizing their potential to appreciate over time. The concept of "laying down" wines, allowing them to mature and increase in value, has been a practice that echoes across the vineyards of Europe and beyond.

The Art And Science Of Wine Investment

Fine wine investment is a nuanced interplay of art and science. Unlike stocks or bonds, the value of a bottle is influenced by a myriad of factors, from the reputation of the producer and the vintage's quality to the wine's condition and provenance. Investors often navigate this intricate landscape by leaning on the expertise of sommeliers, market analysts, and wine critics to inform their choices.

Diversification In Wine Investment

One of the key attractions of fine wine as an investment is its potential to diversify a portfolio. Wine, often considered a tangible asset, stands apart from more traditional forms of investment, offering a unique avenue for wealth preservation. The lack of direct correlation with broader financial markets means that fine wine can act as a hedge against economic volatility, providing stability when other assets may falter.

Investment-Grade Wines

Not all wines are created equal in the investment landscape. Certain bottles, often referred to as "investment-grade," hold more allure for investors. These are wines produced by esteemed estates, from renowned regions, and during exceptional vintages. Iconic names like Château Lafite Rothschild, Romanée-Conti, and Screaming Eagle have become synonymous with premium investment-grade wines.

Investing Before Bottling

A distinctive feature of fine wine investment is the concept of en primeur, a practice where investors purchase wine while it is still in the barrel, before it is bottled and released to the market. This allows investors to secure wines at a lower price with the expectation that their value will appreciate once the bottles are ready for consumption.

Financial Performance Of Fine Wine

The financial performance of fine wine as an asset class has garnered attention. Various indices, such as the Liv-ex Fine Wine 100, track the value of a basket of top wines, offering a glimpse into the market's overall health. Over the past few decades, fine wine has demonstrated respectable returns, rivaling or even surpassing some more conventional investment options.

Challenges And Considerations

While the potential returns on fine wine investment are enticing, managing a wine portfolio comes with its challenges. Storage conditions, provenance, and ensuring the wine remains in optimal condition are crucial considerations. Additionally, navigating the complexities of buying and selling wines, often through auctions or specialized merchants, requires a level of expertise.

Market Dynamics

The fine wine market has evolved from a predominantly European affair to a global phenomenon. As emerging markets, particularly in Asia, have developed an appetite for fine wine, the dynamics of the market have shifted. Auction houses and merchants in Hong Kong and mainland China, for example, have become major players in the fine wine trade.

Cultural Shift

Beyond the financial aspects, the cultural shift towards viewing wine as both an experience and an investment has propelled the market. Collectors and investors alike are drawn not only to the potential returns but also to the stories behind each bottle, the craftsmanship of the winemakers, and the rich tapestry of cultures woven into the world of wine.

Challenges And Risks

Investing in fine wine is not without its challenges and risks. The market can be illiquid, with a lack of standardized pricing, making valuation complex. Economic downturns, changing consumer preferences, and unforeseen events, such as geopolitical tensions or natural disasters, can impact the fine wine market, requiring investors to approach it with a discerning eye.

Frequently Asked Questions

Who Is Pierre Chen, And Why Is His Wine Collection Making Headlines?

Pierre Chen is a Taiwanese billionaire known for his vast wine collection, set to be auctioned for $50 million, making it one of the most valuable ever sold.

Which Auction House Is Overseeing The Sale Of Pierre Chen's Wine Collection?

Sotheby's, a prestigious auction house, is orchestrating the sale of Chen's monumental wine collection.

How Much Is Pierre Chen's Wine Collection Expected To Fetch At Auction?

Chen's collection is anticipated to fetch a staggering $50 million, potentially setting a new record for the most valuable wine collection ever sold.

How Does The Auction Balance The Practicality Of Amassing A Vast Wine Collection With Personal Consumption?

The auction raises questions about the practicality of amassing such a vast collection, sparking a broader discussion among wine enthusiasts about the balance between collecting for investment, appreciation, and personal enjoyment.

What Broader Impact Does The Auction Have On The Luxury Wine Market And The Perception Of Wine As An Alternative Investment?

The auction serves as a barometer for the health and vibrancy of the luxury wine market, showcasing the global elite's increasing interest in fine wine as a valuable and prestigious investment.

Conclusion

Taiwanese billionaire is going to sell 25,000 rare wine bottles worth $50M. As the curtain rises on Pierre Chen's wine auction, it invites us to savor more than just the liquid in the bottles. It beckons us to relish the extravagance of a life dedicated to the pursuit of vinous excellence. With each bottle poised to find a new home, the auction becomes a rendezvous with history, craftsmanship, and the unbridled opulence that only the world of fine wine can provide.

Morgan Maverick

Author

Morgan Maverick is an unorthodox news reporter driven by an insatiable hunger for the truth. Fearless and unconventional, he uncovers hidden narratives that lie beneath the surface, transforming each news piece into a masterpiece of gritty authenticity. With a dedication that goes beyond the boundaries of conventional journalism, Morgan fearlessly explores the fringes of society, giving voice to the marginalized and shedding light on the darkest corners.

His raw and unfiltered reporting style challenges established norms, capturing the essence of humanity in its rawest form. Morgan Maverick stands as a beacon of truth, fearlessly pushing boundaries and inspiring others to question, dig deeper, and recognize the transformative power of journalism.

Professor Jhiz

Reviewer

Professor Jhiz brings fun to teaching anatomy. Born in China, she shares her fascination for how the body works.

Students say her lectures are lively with jokes and stories. She draws cartoon diagrams that highlight structures creatively.

Professor seeks to inspire curiosity and joy in anatomy. She treats each class like a show using props and costumes.

When not teaching, Jhiz enjoys karaoke and novelty socks. Her goal is passing on a spirit of wonder to students.

Latest Articles

Popular Articles